Bain Capital Tech Opportunities Wso

He began his investing career at berkshire partners after working as a consultant at bain & company. 9 detailed lbo modeling tests and 15+ hours of video solutions.

Bain Capital Is Raising 1 Billion For Tech Opportunities Fund

We invest in companies transforming large traditional industries and provide founders with the support they need to scale fast, expand into new markets and build exceptional companies.

Bain capital tech opportunities wso. The most obvious quantitative metric is perhaps the easiest to rely on. We are an affiliate of bain capital, a leading alternative investment firm with unparalleled access to fortune 5000 companies. Prior to rainier, jon was a managing director of gemspring capital.

Mega funds have the most amount of money: Bain capital employees rate the overall compensation and benefits package 4.4/5 stars. Since our founding in 1984, we’ve applied our insight and experience to organically expand into several asset classes including.

Click “agree” if you agree with our policy. The average bain capital salary ranges from approximately $62,832 per year for a portfolio operations associate to $231,741 per year for a vice president. While wsp and wso offer multiple products, both have a version of a “complete” flagship product that includes what typically represents the “core” investment banking financial modeling skill set.

Healthcare services provider multiplan has agreed to go public through a reverse merger with churchill capital corp. Finance manager at bain capital tech opps salem,. Since our founding in 1984, we’ve applied our insight and experience to organically expand into several asset classes including.

The team has been executing the strategy since 2010, prior to joining bain capital, and has invested over $4b of equity in more than 400 assets. People our team draws upon individuals with senior experience in both the life science industry as well as public and private healthcare investing. Private equity international's database of global private equity lp, gp and fund profiles is continually updated by our expert team.

Since our founding in 1984, we’ve applied our insight and experience to organically expand into several asset classes including. Bain & company is aware of various employment scams involving interview and offers of bain & company employment through the use of imposter websites, social media profiles, spoofed email addresses and other fraudulent means. Bain capital ventures and bain capital tech opportunities boston, ma.

What is the highest salary at bain capital? We use cookies to customize your user experience. Before that he worked at bain capital and altamont capital partners.

Wso, and investran show more show less. Our recruiting process is outlined on this site. When discussing funds, we frequently use the metric assets under management, which refers to the total amount of capital a private equity fund has raised since its inception.assets under management is a cumulative figure, including all money raised by the firm.

Since our founding in 1984, we’ve applied our insight and experience to organically expand into several asset classes including. Trusted by over 1,000 aspiring private equity professionals just like you. These are not affiliated with bain & company and are not legitimate.

Multiplan to go public in $11b spac deal. We can make introductions to potential customers across the globe. Bain capital life sciences pursues investments in pharmaceutical, biotechnology, medical device, diagnostic, and life science tool companies across the globe.

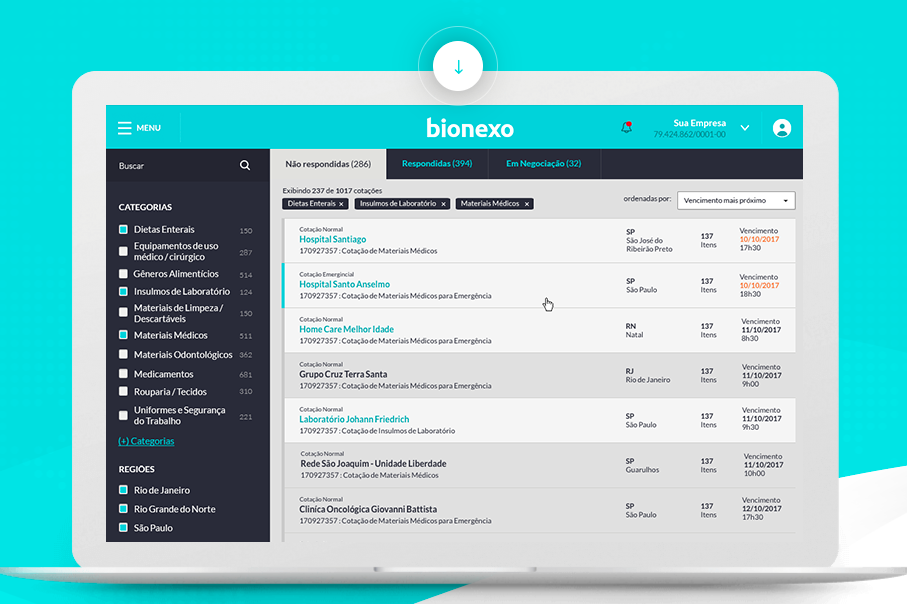

We combine deep domain expertise with the ability to tap the global reach, insight and relationships of the broader bain. We can help you scale and build highly efficient commercialization engines to help your company grow faster on less dilution. Bain capital tech opportunities pursues investments in application software, fintech and payments, healthcare it and infrastructure & security.

In 2019, we invested in arka, an advanced technologies company serving the u.s. When considering in which financial modeling program to enroll, factors such as price, support, content. Wall street prep vs wall street oasis.

Increase policyholders from 1.2 million to over 2 million reclaim its position as a top 3 provider of. As part of our thematic work in aerospace and government services, tac opps is focused on innovative companies working to deliver breakthrough solutions to the public sector.

Tom Baker Cpa - Finance Manager - Bain Capital Linkedin

Biocatch Closes On 145 Million Investment Led By Bain Capital Tech Opportunities Bain Capital

Bain Capital Tech Opportunities

Ffenv Midterm Qp Pdf Venture Capital Corporate Finance

Bain Capital Ventures Logo Vector - Svg Png - Logovtorcom

Biocatch Closes On 145 Million Investment Led By Bain Capital Tech Opportunities Bain Capital

Bain Capital Private Equity

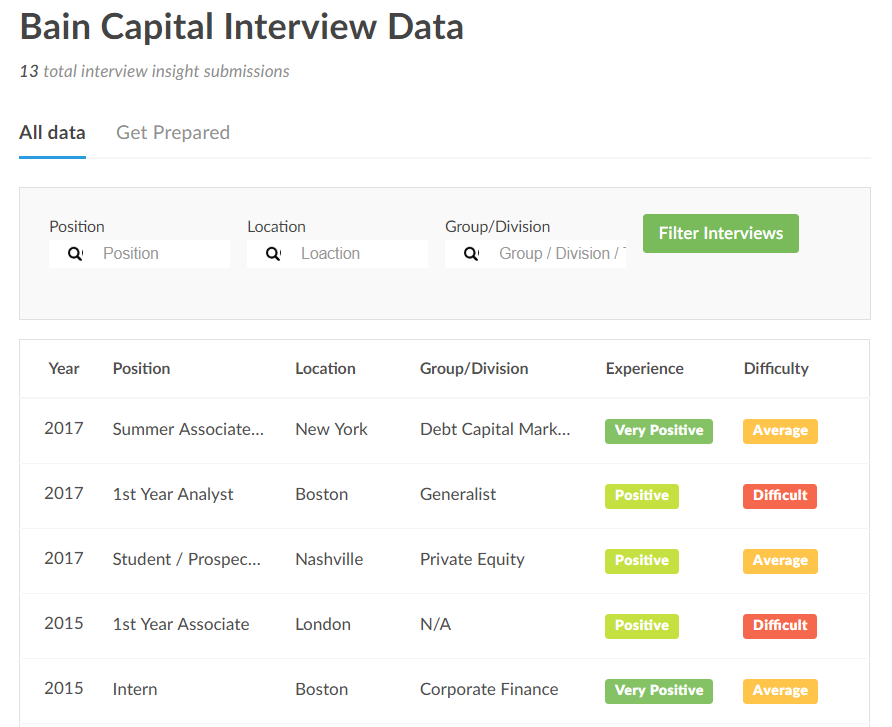

Bain Capital Sankaty Advisors Wall Street Oasis

Bain Capital Tech Opportunities

Bain Capital Tech Opportunities

Bain Capital Targets 15 Billion For Second Tech Opportunities Fund

Bain Capital Tech Opportunities Investor Profile Portfolio Exits Pitchbook

Bain Capital Is Raising 1 Billion For Tech Opportunities Fund

Wall Street Oasis - Podcast Addict

Wso Private Equity Guide Notes Pdf Private Equity Leveraged Buyout

Bain Capital Tech Opportunities - Crunchbase Investor Profile Investments

Hudl The Global Leader In Sports Performance Analysis Solutions Announces Growth Investment From Bain Capital Tech Opportunities

Lek Vs S So Atk Parthenon Ow For Pe Exit Opps What About Lek Vs Mbb Fishbowl

Bain Capital Interview Questions Glassdoor